Imagine exploring the hidden gems of the world without worrying about your budget. Yes, we have been doing it as a family of 3 for the past 8 years covering 9 countries & 110+ cities . Sounds like a dream come true, right? Unfortunately, most of us can’t afford to travel the world without a financial plan in place. But don’t let money woes ruin your travel dreams just yet. With the help of a consumer loan on the go through digital mode , you can fund your adventure without breaking the bank. In this article, we’ll guide you through the process of choosing the best financing solution for your travel needs and share pro tips on making the most out of your travel loan. So, get ready to turn your travel dreams into a reality with these simple steps:

- Key Features to Look while financing your travel plans :

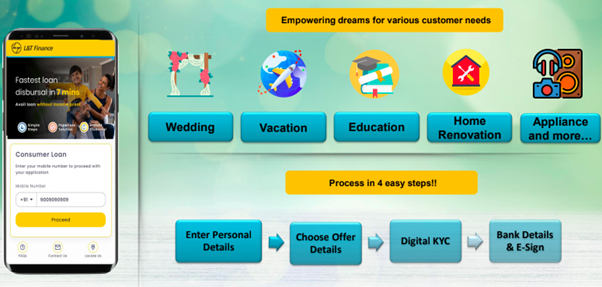

When choosing a source to fund your travels, you need to consider a few key features to ensure a smooth and stress-free experience. Firstly, look for a lender who is reliable & trustworthy with presence across offline & online channels. L&T Finance is one such NBFC operating for decades in the Indian market .

Secondly, consider the interest rates and fees associated with the loan. It’s important to choose a platform that offers competitive rates and minimal fees to avoid any unnecessary expenses.

Thirdly, check the app’s accessibility and usability. A good platform should have a user-friendly interface and be available in multiple languages to cater to a wider audience. Luckily, the PLANET APP developed by L&T finance is rich in all the features with 12+ regional languages. Finally, consider the loan amount and borrowing period offered by the app. Make sure they align with your travel plans and budget. By keeping these key features in mind, you can choose a loan that best fits your travel needs and budget. Up next, we’ll explore the pros and cons of different loan apps to help you make an informed decision.

- Pros and Cons of Different Loan Apps :

Each loan app has its own set of benefits and drawbacks that you must carefully consider before making a decision.

Some loan apps provide quick approval and funding, making them ideal for travellers in urgent need of funds. Like once while travelling to France we planned to extend the stay by 7 more days and calculated fund needs of INR 90,000 . So we looked for a Digital platform with quick processing based on CIBIL score and PLANET APP has the lowest turnaround time among all . A few loan apps offer lower interest rates, but the loan processing time may take longer, which may not be suitable for travelers who need money immediately.

Additionally, some loan apps require a good credit score while others do not, but those that do not may have higher interest rates to compensate for the added risk. Some loan apps also limit the borrowing amount and duration, which may not work for those who require a larger loan or longer repayment period.

- How to Compare Loan Offers

When comparing loan app offers, consider the fees associated with the loan. Some loan apps may have an origination fee or early repayment fee, which could add to the cost of the loan. Also, take into account the interest rate, as this will directly affect how much you’ll be paying overall.

In addition to fees and interest rates, look at the borrowing limits and repayment periods offered by each loan app. If you need a larger loan, some apps may not be able to accommodate your needs. Similarly, if you need a longer repayment period, make sure the app you choose allows for that option.

Once you have chosen the right loan app for you, it’s time to learn how to make the most of your travel loan.

- Making the Most Out of Your Travel Loan

After securing a travel loan, you want to make sure that you are using it effectively to make the most out of your travels. Here are some tips to help you maximize the benefits of your travel loan:

- Plan your expenses: Before you embark on your trip, plan out your expenses and make a budget. Allocate funds for transportation, accommodation, food, and activities. This will help you stay on track and avoid overspending.

- Use the loan wisely: Avoid using your travel loan for unnecessary expenses such as shopping or entertainment. Instead, use it for essential expenses that you have planned for, such as flights, accommodation, and travel insurance.

- Make timely repayments: To avoid accruing extra interest charges, it’s important to make timely repayments of your loan. Set up automatic payments to ensure that you don’t miss any deadlines. Luckily PLANET APP allows swap mandate to easily manage auto debit streamlining the loan repayment and reduces the chance of any late fees.

In summary, financing your travels can be a daunting task, but PLANET APP can offer a convenient solution. By understanding key features and comparing different loans , you can find the perfect fit for your travel needs. Go ahead, Download PLANET APP by L&T Finance & discover the PLANET APP to be carefree for funding your travel plan like we are .

As the saying goes, “Travel is the only thing you buy that makes you richer.” Safe travels!

Here is the QR code to download the PLANET APP by L&T Finance.

Planet App seems a good and quick way to get a personal loan provided one has a good CIBIL score. This detailed explanation of how to compare which consumer loan will be best suited to our needs was quite a life saver.

I appreciate your article on choosing the best consumer loan for travel adventures. It provides valuable insights and tips to help readers make informed financial decisions while planning their trips. Well done!

Consumer loan just a few clicks away is really a boon when there is urgent requirement of money. The PLANET app seems a great medium to fulfill instant needs.

We never considered going for a travel loan till now but after reading this I realise that it’s a great way to fulfill our travel dreams while not worrying about immediate finance needs. Planet App definitely seems very useful.

We had never availed Travel loan before but now it seems worth after reading this post. Thanks for sharing this !!

I had no idea that we can take consumer loan for our travels too. This Planet App sounds like an amazing option to get a quick loan without any hassles and it comes from a reliable and trustworthy brand.

Have been reading a lot about Planet app. It seems like a boon for any wanderlust-filled soul. It’s great to have know on making smart financial decisions to ensure memorable and stress-free adventures. Thanks for sharing this helpful resource with us!

Planet App is really good way to avail consumer loan for any purpose. This app is really a boon when there is urgent requirement of money.